Health Insurance for the Community Where We Live

We are a local, nonprofit health insurance company. Like you, we live and work in Colorado. As part of the Colorado health insurance marketplace, we have some of the most comprehensive and affordable benefits in the state.

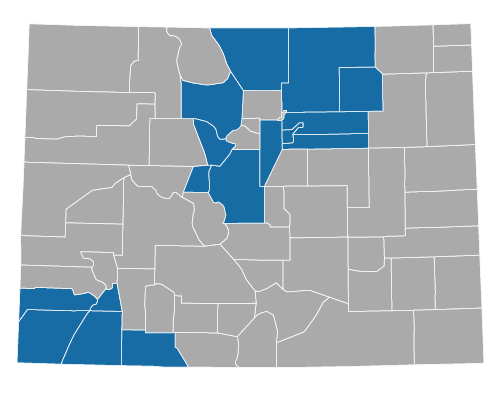

We cover Denver metro and northern Colorado counties and partner with Peak Health Alliance to offer coverage in the mountain and southwest regions.

Elevate Health Plans individual and family plans are available in these Colorado Counties:

- Adams

- Arapahoe

- Archuleta

- Denver

- Dolores

- Grand

- Jefferson

- La Plata

- Lake

- Larimer

- Montezuma

- Morgan

- Park

- San Juan

- Summit

- Weld

In-Network Providers

- Denver Health providers and facilities in the Denver Metro area and the Denver Health Winter Park clinic

10 Family Health Centers

18 School-Based Health Centers

Denver Health Medical Center

Denver Health Outpatient Medical Center - Banner Health providers and facilities in Larimer, Weld and Morgan Counties

Find a Provider

- In-network providers include these and more

4 Corners Children's Clinic

CommonSpirit Health facilities (formerly Centura)

Denver Health Winter Park Clinic

Durango Surgery Center

Middle Park Health

Pagosa Springs Medical Center

Pediatric Partners of the Southwest

St. Vincent General Hospital District

Summit Community Care Clinic - In-network hospitals and medical facilities include these and more

Animas Surgical Center at Escalante

Denver Health Medical Center

Kremmling Memorial Hospital

Longmont United Hospital

Mercy Regional Medical Center

Middle Park Health

OrthoColorado Hospital

Pagosa Springs Medical Center

Penrose Hospital

St. Anthony North Hospital

St. Anthony Summit

St. Elizabeth Hospital

St. Francis Hospital

St. Mary-Corwin Hospital

St. Thomas More Hospital

St. Vincent General Hospital

Learn more about our Peak plans

Find a Provider

Elevate Health Plans Benefits Include:

Integrated Care

Your primary care provider (PCP) coordinates all aspects of your care — including primary and specialty care, pharmacy needs, lab work, behavioral and mental health services and hospital care.

Urgent/Emergency Care

Coverage at any urgent care center or emergency department in the U.S.

Prescriptions

Your plan covers prescriptions at Denver Health pharmacies as well as national network pharmacies, such as MedImpact Direct Mail® (serviced by Birdi™ pharmacy), King Soopers (excluding The Little Clinic), Walgreens, Safeway and most large retail pharmacy chains.

Both MedImpact and Denver Health have pharmacy by mail options for added convenience.

Prescription Discounts

Save as much as 50-75% on prescription costs at Denver Health Pharmacies. Members can call the Denver Health Pharmacy at 303-436-4488 for updated pricing.

Which Plan Is Right For You?

Bronze

Low monthly premiums and higher copays and out-of-pockets cost

If you don’t access care often but want the security of knowing you have coverage when you need it.

Silver

Moderate monthly premiums and moderate out-of-pocket costs

Good option if you require some health care services but don’t want to pay higher premiums.

Gold

Higher monthly premiums and lower out-of-pocket costs

Good choice if you have a lot of health care needs — you’ll pay a slightly higher monthly premium to cover your health care costs.

Health Care That Fits Your Life Today

We get it. You’re looking for personalized, convenient health insurance benefits, with easy access to your providers and your health information. You need primary care, specialty care, urgent and emergency care. You want preventive care and care for your body and your mind. You want to talk to a human being when you have a question about your benefits or how to access care. You want convenience. We can help with all of that.

Affordable Care Act

You may qualify for a federal tax credit or subsidy under the Affordable Care Act. We can help you find out. You can also use our shopping and enrollment tool to see what kind of savings you qualify for, before you sign up.

Additional plan information can be found in member resources, including member handbooks and summary of benefits and coverage for each specific plan, pharmacy and the health insurance glossary.

Colorado Option plans have the same benefits and cost-sharing across all health insurance carriers in Colorado. These plans generally have lower premiums and cover basic healthcare needs, considered “essential healthcare” under the Affordable Care Act. Individuals and families can enroll in Colorado Option plans via Connect for Health Colorado, Colorado Connect or directly through DHMP.

We care about your privacy. Our Notice of Privacy Practices details how Protected Health Information (PHI) about you may be collected, used and disclosed and how you can get access to this information.